How That Friends Bought Its Dream House with the lowest Credit Rating

Envision two, as you and you can me, who had a massive wish to own a home that they you’ll pour its like and you will sweating toward upgrading. However, there is certainly a catch their fico scores just weren’t an informed. We’re these are numbers on 580s, nearly what most banking companies create smile during the.

Very, they stumbled on us hopeless however, alarmed, asking for assist. I place our minds together and developed an idea. Because of the teaming upwards, installment loans online in Maryland with bad credit into partner signing up for the application given that a beneficial co-debtor, we dived with the a hands-towards the comment process due to their financing. That it was not merely people mortgage but an enthusiastic FHA 203k mortgage designed to have circumstances such as for instance theirs.

What is actually great about an enthusiastic FHA 203k loan is the fact they embraces group that have below 600 credit ratings. It’s good for purchasing a house that really needs some like and you can upgrading-what our very own few imagined.

Timely forward to today, plus they are residing in that dream house. Its story is a bona-fide example of just how, toward proper assist and you may an FHA 203k mortgage which have below 600 credit ratings, turning a big dream on the the reality is very likely.

Willing to Get started?

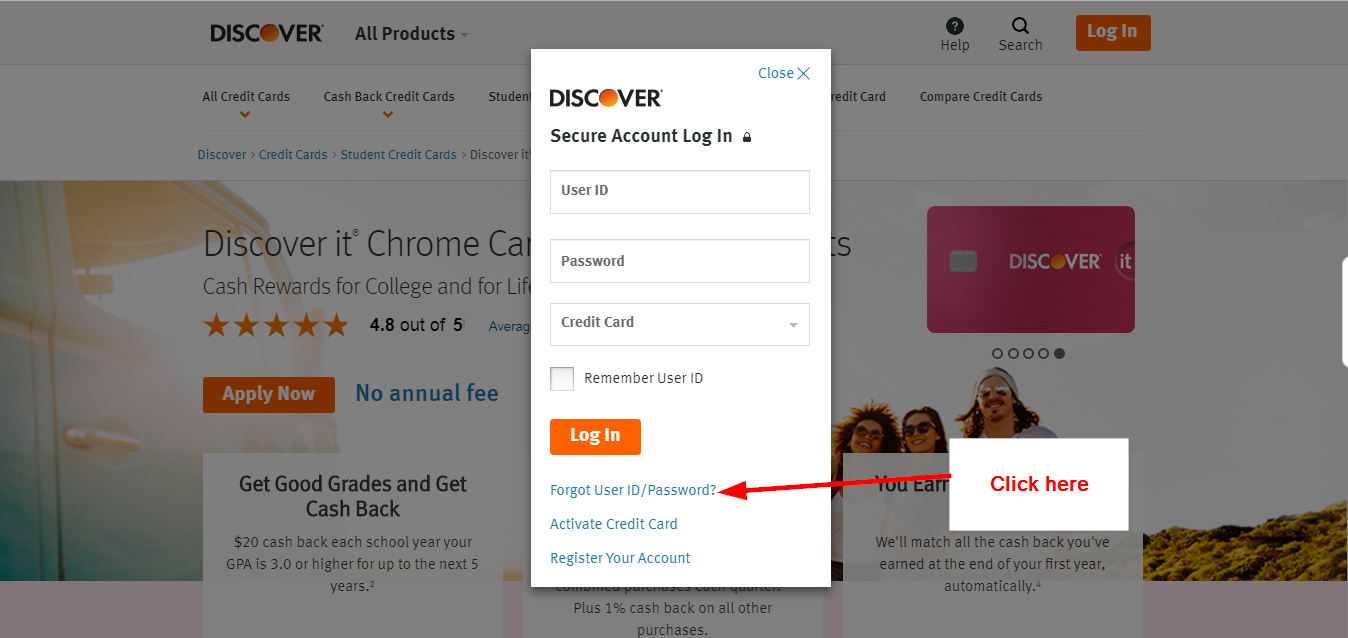

Whenever you are willing to get and you will renovate property but alarmed regarding the credit score, don’t allow one hold your right back. Within Gustan Cho Partners, we focus on permitting consumers that have reasonable credit ratings get approved getting FHA 203k fund. In case the credit score are 580, 550, if you don’t straight down, the audience is here to assist. Follow this link to apply for FHA Loan Immediately following Bankruptcy proceeding

E mail us right now to learn how we are able to help you change that fixer-higher to your dream household, no matter if your credit rating are lower than 600.

- Call us: 800-900-8569

- Email:

- Text message Us: The audience is readily available seven days a week, as well as vacations.

FAQs: Reduced Borrowing? Get FHA 203k Financing That have Below 600 Fico scores

- step one. Ought i get an FHA 203k financing having below 600 borrowing results?Sure, you might! Some loan providers favor large results, certain, such Gustan Cho Partners, focus on permitting those with credit scores significantly less than 600 get approved to own an enthusiastic FHA 203k financing.

- dos. What exactly is an FHA 203k mortgage?An enthusiastic FHA 203k loan is actually another mortgage that lets you purchase a great fixer-higher and you can borrow funds and also make fixes, all in one loan. Its perfect should you want to change a rush-down house into the dream house.

- 3. How come my lowest credit rating apply at getting an FHA 203k mortgage?Whether your credit rating are under 600, providing a keen FHA 203k loan might encompass more paperwork, eg instructions underwriting, however it is naturally you are able to. Loan providers tend to consider carefully your done budget, and not simply your credit rating.

- cuatro. Could it be harder to be eligible for an FHA 203k financing that have around 600 credit ratings?It may be some time tougher, however impossible. You may need to focus on a lender who is happy to take on compensating situations, such as for instance steady money or a larger downpayment.

- 5. Exactly what are the great things about an enthusiastic FHA 203k financing with not as much as 600 credit scores?No matter if your credit rating is less than 600, you can aquire a house and you will receive financing to upgrade it with a keen FHA 203k mortgage. While doing so, a small deposit is all that’s needed, therefore the mortgage is supported by this new FHA, and work out recognition simpler.

- six. Do I wanted good co-borrower to locate an FHA 203k financing which have significantly less than 600 credit score?Which have a great co-borrower with a high credit rating will not guarantee acceptance getting an enthusiastic FHA 203k mortgage which have below 600 credit ratings, however it increases the possibilities of providing accepted.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!