So it reviews on this blogs reflects the private views, feedback, and investigation of creator rather than CenterState Lender

No matter what the lender really does to have audit preparation, it is a good time today, if you have not already done so, to send every or an example regarding funds through an excellent assurance strategy to discover people circumstances today as you have a way to resolve things such as the mortgage number to the SBA. Banking companies one hold off can find a more challenging time later on.

CenterState Bank are a beneficial $17B ($35B article-merger closure), publicly-replaced community bank in the Southern area playing around our very own method to the a beneficial travel to be a $100B most readily useful-carrying out organization

Another aspect of that it effort are funding considered and you will cost management. Surely right now, you have another general ledger account set-up to manage the fresh new charge and you will expenses below this option. For these finance companies, it is crucial to make an opinion cycle and way to upgrade you to definitely loans Hot Sulphur Springs finances once the the fresh new pointers becomes readily available. Instance, it is unclear the amount of creativity energy will be required to utilize the SBA’s XML/API link with transfer forgiveness studies. It’s been rumored your conditions would-be out by the conclusion the brand new few days, it means finance companies need kepted each other finances and you may technologies info to manage during the early Summer.

Financial institutions had to clipped enough process corners while in the origination to meet the latest timelines and you can stress. That it certainly has established more issues than the world knows about. At the same time, the fresh origination procedure mostly focused on eligibility, that has been obvious, and calculation are centered on a simple 2.5x payroll. Today, banking institutions will likely not only suffer from every the difficulties that were planted throughout manufacturing however, the various out-of tens and thousands of types of dilemmas so you can process. The greater amount of banking companies consider this step now, the greater amount of we are supplied to minimize exposure, include cost, and maintain risk to a minimum.

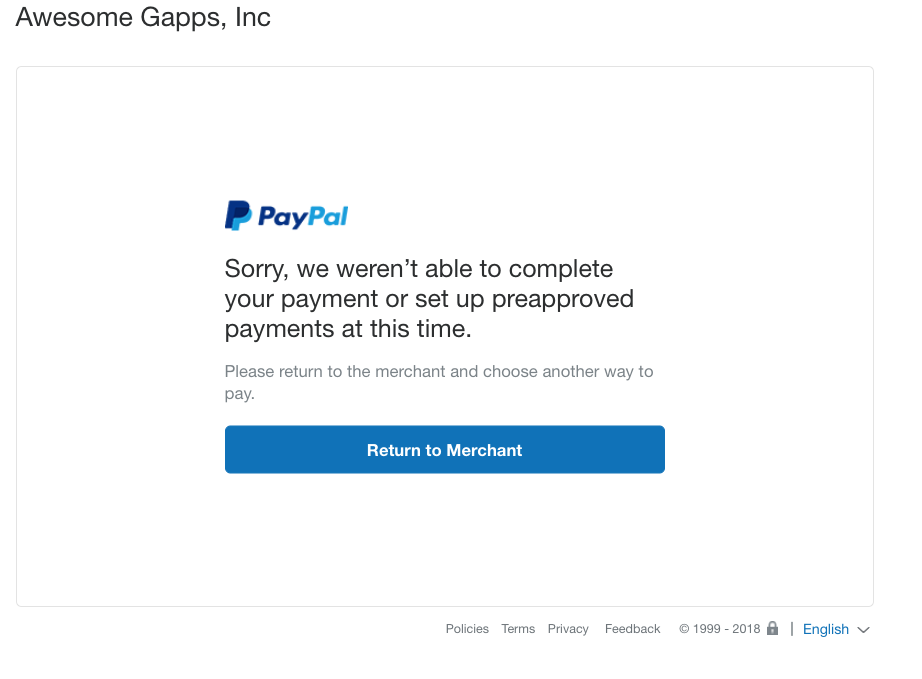

How would you like an application to help with forgiveness taking on the membership these? We’re examining an effective way to assist for approximately $sixty for every single effective software. If interested, get a 2-minute questionnaire and you will register Right here. We’ll following give considerably more details.

When you are a financial institution, gain access to our Web log Right here , go after our micro-writings with the Fb Here and/otherwise join our very own podcast in iTunes Right here.

Particular banks have chosen to take that it one step further and also have passed spending plans for it efforts to provide loan forgiveness and you may administration

This web site is only meant to provide standard degree towards financial community, management, exposure management, or other related subject areas and that is maybe not meant to offer any specific advice. Banking companies is always to request its pros and totally discuss one chance and you can risk referenced herein.

Economic suggestions can be obtained Here. CenterState provides one of the primary correspondent lender communities regarding the financial world and you can renders its research, procedures, seller studies, services thoughts open to people facilities you to desires to need the journey with our team.

Within the forgiveness workflow, banking companies should framework how to effortlessly consult further documentary facts, look after errors, and you can find explanation. Convinced using and you can starting an answer bundle which is during the positioning toward risk and also the difficulty of your own demand now usually help save a whole lot of your energy later on. Banks have the ability today so you can pre-write and you will refine answers that individuals didn’t have during origination.

Audit & Quality-control: Brand new SBA has already reported that they intend to review financing above $2mm and you may shot the remainder. In the event that correct, it pays to possess banking companies to build the electronic file business today, do control schedules (while making auditing more effective), and you may assign a single area from get in touch with so you can station audit requests.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!