What is causing household security financing interest rates to decrease? And can it remain shedding?

Brand new Government Reserve opted for a rate slash last few days, and more slices would-be on the horizon while we direct into 2025.

So far, the disperse keeps lead to all the way down costs on home security activities – particularly domestic equity lines of credit (HELOCs) . In fact, the average rate to the good HELOC keeps decrease from the average out-of 9.99% at the start of September to eight.69% now.

At the same time, costs towards antique mortgage loans has grown. What exactly is behind this, and can i anticipate home security prices to keep falling?

What causes family equity financing rates to drop? And certainly will they remain Floyd Hill loans losing?

Here is what advantages have to say about what drives family guarantee loan rates – and whether they have been likely to fall-in the near future.

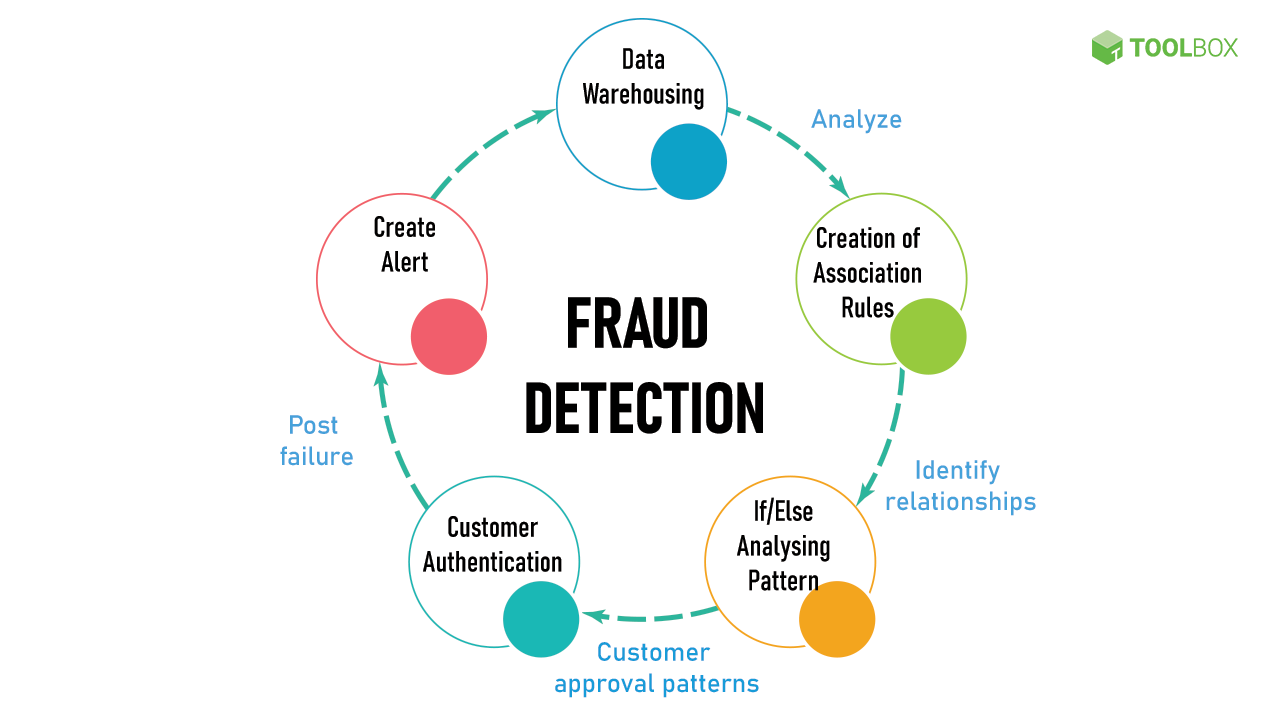

HELOCs is directly associated with new Fed’s price

To get obvious: It is largely HELOC rates that have fallen not too long ago. When you’re home security loan costs has actually dipped some, it’s merely been by several affairs.

How come HELOCs are inspired, positives state, is that its cost is in person based on the Fed’s speed – often referred to as brand new government money speed.

“HELOC prices usually make use of the prime speed while the a kick off point, that is always a number of items more than this new Given speed,” states Rose Krieger, older financial professional at Churchill Financial. “Very, whether your Fed rate comes down, we can welcome the finest rate can come off as the well, decreasing the complete performing rates having HELOCs.”

It is not only doing pricing that have fell, though. While you are the fresh HELOC borrowers are benefitting, established HELOC consumers in addition to victory aside with present decreases. This is because HELOCs try changeable-price products. That means when its list price falls, so really does the rate on the most recent HELOCs. This can decrease your interest will cost you and you may monthly premiums.

“Property owners with HELOCs just watched a great .50% price prevention a month or more in the past if the Provided quicker pricing because of the .50%,” claims Bill Westrom, Chief executive officer regarding personal line of credit banking platform Basic facts Inside Collateral.

Almost every other borrowing products for example credit cards are also based on the primary speed, so those have seen decrease for the present days, also (whether or not much smaller of those than just toward HELOCs).

“One of the benefits of Feds’ current choice to cut the fresh federal financing rates would be the fact its was the cause of rates to your HELOCs, handmade cards, and you can a number of other activities to-fall as well,” states Darren Tooley, financing manager in the Union Mortgage.

Financial costs are derived from other factors

Long-identity home loan rates are not directly connected to the Fed’s rates. Given that Fed’s movements perform influence these to a point, the new correlation is much more nuanced, and there are numerous much more items one play inside the also.

“The fresh new Government Reserve doesn’t manage home loan cost personally,” Westrom states. “Mortgage prices was associated with the latest 10-year Treasury, perhaps not the fresh new Government Put aside. Fed price conclusion features a primary apply to on the currency flow on Wall structure Highway, and it is that money move one influences financial prices.”

“This new MBS markets got expected the fresh new Given reducing cost until the certified statement, thus financial prices transpired into the September when you look at the expectation of one’s reduce,” Tooley claims. “Not long following the Provided established reducing rates, the united states Bureau out-of Work Statistics came out featuring its Sep amounts, that have been much stronger than just anticipated, negatively impacting the latest MBS field, and therefore much causing financial cost to boost into the Oct.”

Cost you can expect to fall after that

The latest Government Reserve still has two group meetings left getting 2024 – one in November and one within the December. With regards to the CME Group’s FedWatch Product, there is a beneficial 91% likelihood of an alternate speed cut in November and an effective 77% chance of another type of cut-in December.

With that said, you’ll be able to HELOC prices – and you can potentially domestic collateral and much time-name mortgage cost also – tend to lose consequently.

“The new Fed’s price decision will be based on its review of the current county of your cost savings and its guidelines – mainly predicated on such things as inflationary data, employment design, and jobless,” Tooley claims. “Its widely calculated this are the first of several future speed slices between today and the stop from 2025.”

As of now, Federal national mortgage association tactics the common 30-year speed have a tendency to slip so you can 6% because of the year’s stop and you may 5.6% towards the end out-of 2025. There aren’t any official forecasts for household equity rates, even when Westrom states the guy believes a decline out-of 0.twenty-five to 0.50% into the HELOC rates is possible along the second 3 to 6 months.

“Sadly, my personal crystal golf ball is just as foggy since the people else’s,” Westrom claims. “You will find plenty contradictory studies and thus of several parameters that affect the Fed’s decisions. All of the we could really do are view, waiting, and you may answer the world all around us.”

The bottom line

Whenever you are would love to take-out a HELOC or home security financing you can expect to mean lower interest levels, that is not always ideal move – especially if you you prefer dollars today. Domestic collateral activities normally have lower costs than playing cards, therefore if might turn-to vinyl getting any type of costs you would like protected, a great HELOC or household equity loan is sometimes a better choice.

You can even reduce the pace you get on your mortgage of the improving your credit score before you apply. With many collateral yourself can also help.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!