How to get Eliminate MIP Premium to your a keen FHA Financing

FHA Financial Insurance policies elimination you could do in several ways eg refinancing or automated treatment.

If you find yourself a citizen that have a mortgage backed by the fresh new Federal Housing Government (FHA), you may have been expenses a monthly fee known as home loan insurance rates advanced (MIP). You have heard that MIP is an essential section of the FHA financing, you can treat they below certain things.

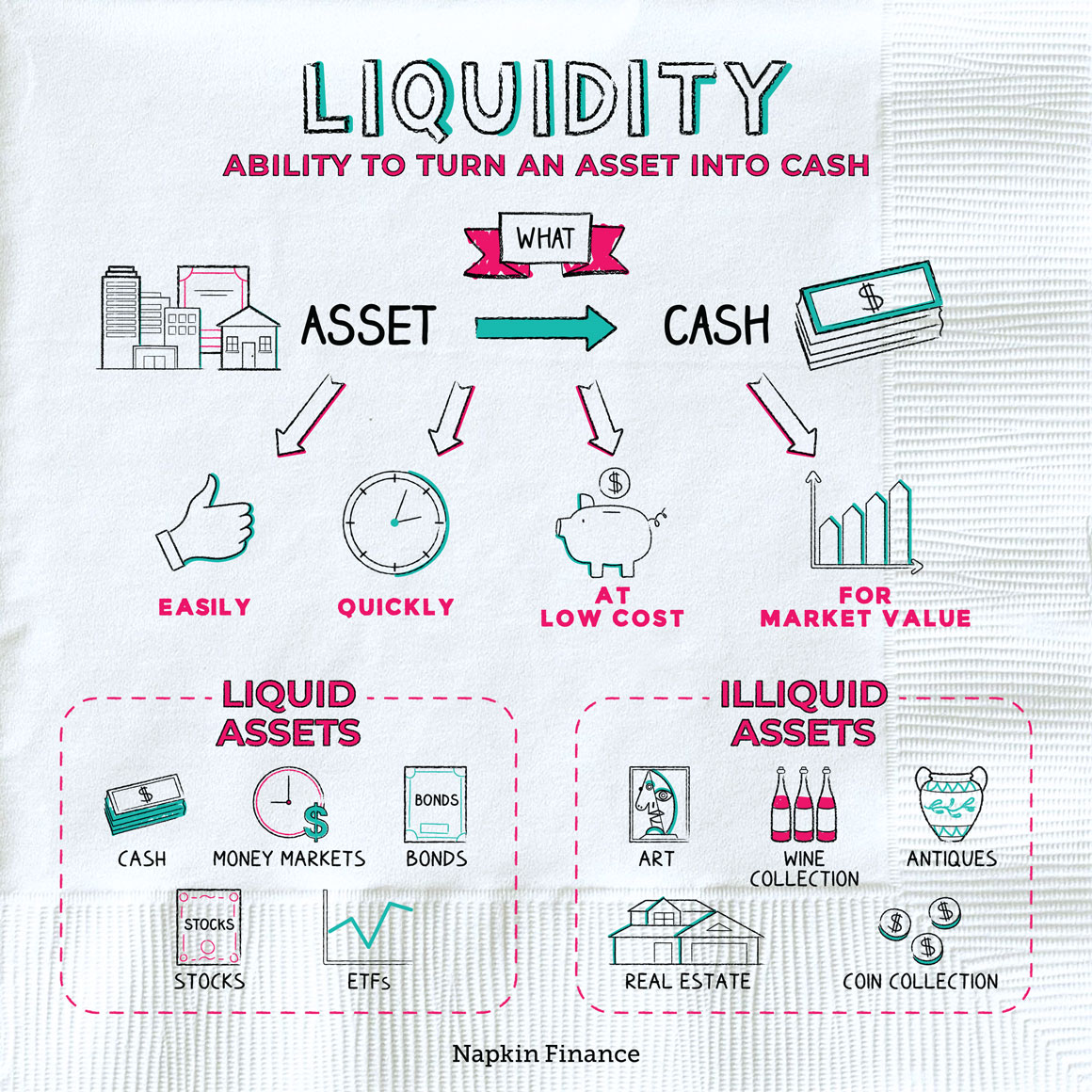

Much like individual mortgage insurance rates (PMI) towards the a normal home loan, MIP is made to include the lender up against losses but if the brand new homebuyer defaults to your financing. MIP superior is computed according to research by the complete number of the newest financing, the mortgage identity, and also the loan-to-worthy of ratio (LTV) proportion. It will cost you from 0.45% to just one.05% of your amount borrowed every year which is sensible many home owners need certainly to learn how they’re able to get it removed.

While use a weblink you are PMI would be terminated whenever the citizen keeps accumulated adequate equity, MIP has its own advanced set of laws and regulations. Essentially, there are three straight ways out of deleting otherwise cutting MIP: automated termination, old-fashioned refinancing, and you can FHA refinancing.

When Can you Shed MIP to the an FHA Financing?

Based your go out off origination and some additional factors, you are capable of getting mortgage insurance policies immediately removed from your existing FHA loan:

- For individuals who established financing ranging from , the MIP will disappear once you started to an LTV from 78%.

- For individuals who unwrapped financing with the or after , as well as your brand-new downpayment is ten% or more, the MIP will go away shortly after 11 age.

Or even satisfy such requirements, financial insurance coverage are required toward lifetime of the loan but that doesn’t suggest you may be out-of luck.

Simple tips to Remove MIP Out-of an effective FHA Mortgage

If you aren’t qualified to receive automatic treatment, you’ve got one minute selection for eliminating mortgage insurance: refinancing your FHA loan so you’re able to a conventional mortgage.

Traditional money constantly require PMI that is much like MIP if you do not have 20% security yourself. But even though you haven’t repaid 20% of your own completely new loan amount, you may possibly have sufficient security in order to meet the requirements. Home values was basically increasing round the all of the U.S., towards average price jumping out-of $223,000 to $336,000 between . Taking another type of assessment will highlight exacltly what the residence is already really worth.

Automatic Insurance rates Reduction having FHA Funds

Whenever you can be eligible for automated elimination, given your financial is in good status and that you see what’s needed above mentioned, you may be at an advantage. Or even must re-finance, you don’t need to pay settlement costs. In addition to this, if you had currently closed for the a beneficial interest rate, you can preserve it.

However, this method off removing mortgage insurance shall be a lengthy-label online game. It takes many years to invest off your loan so you can 78% of one’s modern cost. Typically, towards a 30-seasons fixed FHA financing, it will require about 10 years, if you do not speed the process by creating additional prominent-merely costs.

How-to Refinance Good FHA Mortgage to get rid of PMI

For almost all FHA home loan holders, refinancing so you’re able to a normal mortgage should be an instant and value-effective way to eliminate financial insurance coverage. Check out facts to consider regarding refinancing:

- How much collateral have you got? You need to concur that your brand-new LTV ratio often help you avoid PMI, and that e since the MIP.

- Provides your credit score increased? If that’s the case, you may want to qualify for a much better price than you’ve got today, saving you more funds fundamentally. If you don’t, the newest key is almost certainly not worthwhile.

- What’s their DTI? Most antique lenders like to see a personal debt-to-income (DTI) ratio significantly less than 43% and therefore is sold with besides your mortgage however, vehicles money, college loans, or other costs.

- Just how much try closing costs? After you refinance, you’ll want to spend closing costs on the the loan. Manage the number together with your bank to be certain you to closure costs would not meet or exceed the discounts away from getting rid of MIP.

- Is it possible you get extra cash away? Oftentimes, residents with sufficient equity takes out even more fund after they refinance, that allow you to finance fixes or any other biggest lives expenditures at the mortgage’s rate of interest constantly much lower than simply handmade cards or unsecured loans.

FHA Financial Insurance rates Treatment: Are not Asked Issues

Possess questions? You are not alone. Here are a few issues that people listen to frequently whether or not it pertains to eliminating home loan insurance policies towards the FHA money.

Do FHA Require PMI Instead of 20% Down?

Getting programs completed on or immediately following , every FHA financing require financial insurance policies. If the down payment is actually ten% or higher, monthly obligations need to be covered eleven ages. In case the downpayment is lower than ten%, monthly payments must be taken care of the life of loan.

Is it possible you Eliminate PMI If Domestic Worthy of Expands?

When you yourself have an enthusiastic FHA loan, financial insurance coverage can not be recalculated or got rid of should your family well worth grows. Which have a normal financial, PMI is usually required unless you has 20% collateral home; this can be attained using paydown of dominating and you can/or appreciate of house’s worth. Property is going to be reappraised to decide its latest well worth.

Can you Discuss Regarding PMI?

Whether you have got an FHA mortgage or a normal loan, mortgage insurance policy is ordinarily perhaps not flexible. Having antique financing, the PMI rates is partly dependent upon your borrowing from the bank, therefore optimizing your credit rating get lower your payments. Otherwise, financial insurance is instantly computed predicated on your loan count, financing name, and you can LTV.

Trying to Reduce PMI on your FHA Loan?

You prefer a whole lot more suggestions about simple tips to remove financial insurance rates out of your month-to-month plan for a great? The audience is toward standby. Discover more about how you may be able to replace your present FHA financing with a new mortgage of Union Home loan that aligns together with your specific specifications otherwise e mail us today.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!